Are you Bad At Saving Money? Try These Simple Money-saving Tips

If anything is more complicated than earning money, it is saving money. Gary Vee, the outspoken entrepreneur and financial said this to a large audience in New York. “Hear me out,” he said. “Stop buying things to impress people that you don’t like, with the money that you can’t offer.” He is so right. We often spend extravagantly and lose control over the cash flow.

Do you think you are bad at saving money? I mean, the money that has your blood and sweat? Well, read on for our simple tips to start saving money like never before. Nonetheless, these simple tips will be fruitful in both long-term and short-term money-saving strategies.

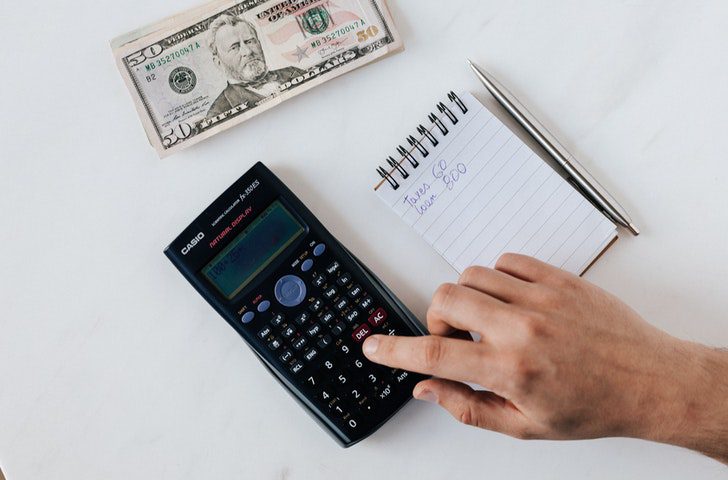

Keep Proper Track of Your Expenses

Saving money is pretty tricky in the beginning stage. After all, it is an attitude that takes time to mold otherwise. So, the first step you can take is to keep a track of your expenses. I mean, observe where your cash is going. Is it needless shopping that is draining your pocket? Or is it household expenses? How about mortgage, gas, and electricity bills?

Once you keep proper track of your expenses, you can manage your expenses accordingly. For example, if it is electricity which is costing you a lot, reconsider it. Reach out to your provider and ask you are billed that much.

Otherwise, you will remain trapped in the Rat Race. You will have no idea where the money is going. Ultimately, you will never know how much do you spend every week or each month.

Cut Back Your Nonessential Expenses

Once you keep track of your expenses, you will be able to find out your nonessential expenses. These could be your cell phone, television, needless outing, shopping, or dining at an expensive restaurant. Cut them down. A convenient way would be:

- Opting for “Cheap Eat” restaurants and avoiding frequent dining.

- Canceling paid memberships that you no longer use. For example, Netflix, Amazon Prime, Hulu, etc.

- Making use of low-cost – or even free – community events for entertainment.

- Passing on to your gut feelings of nonessential shopping.

Set Saving Goals for Yourself

Setting saving goals is one of the efficient tips to save money. Tell yourself what it would look like to have an x amount of money to save. Above all, think about what you could do with that money in the future that you are saving today.

Your saving goal could be purchasing “that killing” Audi, getting married, saving for your kids, or simply having a better lifestyle both for yourself and your family. Once you set a goal, you will efficiently be able to save enough money. I mean a saving that will go a long way.

Review Your Budget Every Month

Once you start saving money, observe your saving grow. One of the efficient ways to see how your savings are growing is by reviewing your budget every month. Analyze how much do you save every month.

Follow these simple tips and save money like never before. You will potentially see yourself getting out of the trap of Rat Race.