The only good thing about a student loan is that you are not alone—every two in three students, graduates with a debt. During tax season, many students wonder if their credit is tax-deductible or not, and if it is, then under what conditions.

A straightforward answer to the above question is – yes, but it is a little tricky. Like every other deduction, student loans also come with their own set of qualifications and limits.

Keep reading to find out how you can reduce the tax burden with the help of your student debt.

How to Qualify?

sctgrhm/Unsplash: There are ways to qualify for tax deductibility

You can claim a tax deduction against the interest paid for the loans. To be eligible, you need to be enrolled in a recognized institution and must have availed the loan when you were halfway into the program or the degree. Your status should also be single, not married.

There should also be documentary evidence that the loan amount was not used towards frivolous activities like dining out or traveling. It should strictly be put to use only for educational purposes such as books, tuition fees, or other study-related matters.

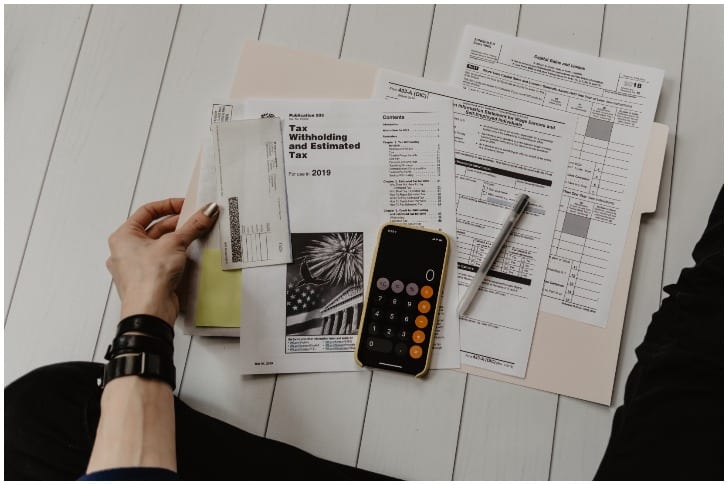

What are the Conditions?

kellysikkema/Unsplash: Certain conditions apply before you can qualify for tax deduction

An amount which is lesser of the following is the maximum deductibility offered for student loans:

a) $2,500

b) The total amount paid as interest (including voluntary prepaid interest amounts paid and mandatory payments)

For example, if the total interest payment in a year comes to $2,600, then you can only claim $2,500, or if the payment made is $900, then you cannot claim more than what you have paid.

The deduction also depends on the Modified Adjusted Gross Income (MAGI) of the taxpayer. If your income is too high, you may not be able to claim the full deduction. Unfortunately, the interest amount that ultimately qualifies for a waiver may be lower or nil entirely.

What can be done to Claim the Deduction?

Don’t worry because there are ways you can survive your student loan debts

Don’t worry because there are ways you can survive your student loan debts

The interest payments can be claimed in Internal Revenue Service’s (IRS) Form 1040 as an adjusted to your declared income. Also, itemizing deductions are not required. If you have made repayments to a single lender, you may have received a 1098-E in the mail, and if you did not receive any form, it means that you are not eligible for the deduction.

In case of any doubts, you can use the IRS online tool to help your figure out if your Student Loan Interest Deduction makes the cut or not.

You can also clarify it with your lenders and ask for more information. It is essential to be fully aware of the fine print because a tax deduction lowers your liability and can be a useful tool.

Tax jargon may sound overwhelming; your best bet will be to consult a professional. They will explain everything to you and provide valuable advice on managing your taxes in a better way.