Marina Andrejchenko/Shutterstock: Freelancers are anxious during the time of 2020 pandemic

Freelancers and self-employed workers already face a fair bit of uncertainty when it comes to earning money. Add on a pandemic and an overall economic slump, even the most successful ones will feel the pressure.

While unemployment remains at an all-time high, gig economy workers are also facing their share of struggles. According to a survey, in 2019, 35% of the USA workforce were freelancers at the time and contributed 5% to the country’s GDP.

In an unprecedented move, the US government has included gig economy workers in the relief package to provide unemployment benefits due to the Coronavirus, paid sick leave, and paycheck protection loans.

If you are someone who has lost their income, then keep reading to find out what measures are available in this crisis.

Families First Coronavirus Act

This act came in force on March 18, 2020, providing sick and family leaves for the freelancers in the pandemic. It allows tax credits to be claimed against 2020’s federal income tax bill and can be adjusted against quarterly payments. If the credit exceeds your income, then the government will provide a refund for the excess amount.

Paid sick leave: If you get ill due to COVID-19, credit can be claimed for up to 10 days.

Paid family leave: If a family member gets sick, or you need to oversee your kids due to closure of schools or daycare, then you can claim the following:

a) 67% of average daily income or,

b) $200/ day for 10 days or $2000,

Whichever is less.

CARES Act

Aysezgicmeli/Shutterstock: CARES benefits for self-employed citizens of America

This act took the rare step of including freelancers and self-employed citizens for unemployment benefits in the pandemic. Under CARES, the Federal Pandemic Unemployment Compensation (FPUC) program was initiated to benefit Americans affected by the lockdown measures. Each week till July 31, 2020, a qualified and eligible citizen will get $600 as regular compensation.

FPUC program has expanded the eligibility of unemployment insurance to independent contractors, gig economy workers, part-time employees, and self-employed workers that have been impacted by the onslaught of the Coronavirus. The time period has been extended by 13 weeks for the people who had their insurance run out.

An application can be made online or with the unemployment insurance program in the state where you are employed.

Other Measures Undertaken

Alex Millauer/Shutterstock: Benefits for freelancers amidst Coronavirus pandemic

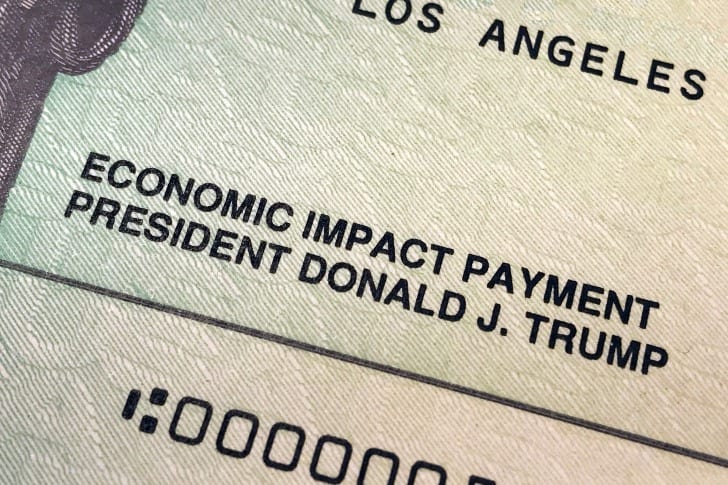

The federal government is also making Economic Impact Payments (EIP) to specific taxpayers who meet the requirements. The payment is deposited straight into the bank account if you have ever deposited tax or received a refund. Otherwise, a check is sent by mail.

The CARES Act provides $1,200 for each individual (and up to $2,400 for couples) and $500 for each child to eligible taxpayers such as:

a) In 2019, individuals who declared income less than $75,000 or $150,000 for couples who filed jointly or $112,500 for couples who file separately, as the head of the household, will be liable to receive the full amount.

b) The payouts then start decreasing by $5 for every $100 made over the threshold limit. If you have declared income above $99,000 ($198,000 couples filing jointly or $150,000 separately), you will not be eligible to receive EIP.

c) If data for 2019 is unavailable, the 2018 statistics can be used as a reference.

Payment Protection Programs were also introduced, but self-employed individuals were only allowed to avail them after everyone else, and unsurprisingly, funds ran out quickly. An additional $310 billion has been added, but it is unclear how long will these last.

In case of any doubts, the Freelancers Union provides up-to-date resources and information on the current happenings. It has initiated a Freelancers Relief Fund to which affected outworkers can apply.

Many states have stopped all eviction proceedings. If you reside in a Development of Housing and Urban Development property or have a mortgage secured through the Federal Housing Authority, then you are safe from eviction or foreclosure for now.

Many aid programs and grants have also surfaced to keep the self-employed workers up the float.

puhhha/Shutterstock: Freelancers are part of country’s workforce

Freelancers are an integral part of the US workforce. Until America is ready to reopen with full-steam, these measures will hopefully manage to help them survive this financial storm.