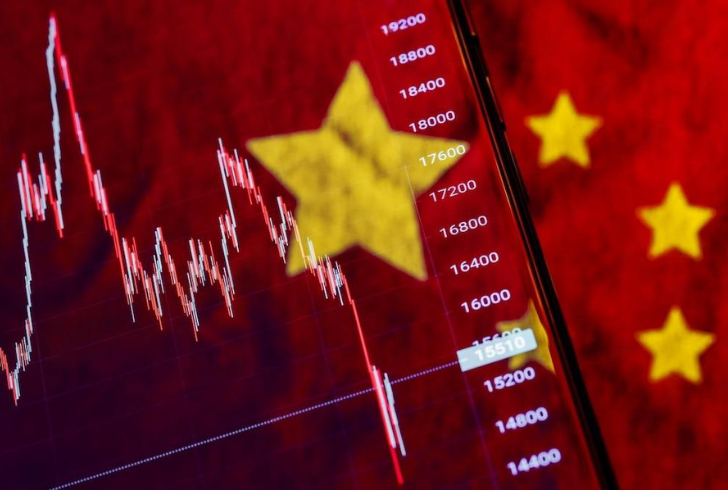

In the dynamic landscape of China’s stock market, a notable transformation has unfolded in recent times. Short positions, a key indicator of market sentiment, experienced a significant contraction in February, marking their lowest point in over three years. This transformation stems from regulatory interventions designed to rein in speculation and instill confidence among investors.

The Regulatory Ripple Effect

China’s regulatory authorities, led by the China Securities Regulatory Commission (CSRC), have implemented a series of measures to stabilize the market. These initiatives include the suspension of brokerages from borrowing shares for short-selling and the prohibition of same-day short-selling. The rationale behind these actions, according to the CSRC, is to level the playing field in a market where retail investors wield substantial influence.

This regulatory stance has seen prominent brokerages like CITIC Securities, GF Securities, and China Securities aligning with the new directives, opting to curtail short-selling activities. While these measures aim to restore balance, market participants, particularly fund managers, find themselves grappling with the unintended consequences.

The Impact on Trading Strategies

Wei Mingsan, General Manager of Zhejiang DeepWin Asset Management Co, highlighted the challenges imposed by these restrictions, particularly in executing the ‘T+0’ intraday trading strategy. Fund managers, critical players in the market, have expressed discontent with the limitations, with Yuan Yuwei from Water Wisdom Asset Management emphasizing the growing difficulty in executing equity long-short strategies.

According to Yuan, both long and short positions contribute to the vitality of value investment. The absence of short-selling could expose the market to heightened volatility. In his view, regulators should focus on tackling market manipulators rather than constraining short sellers.

Understanding the Long and Short of Market Dynamics

The debate unfolding in China reflects the delicate balancing act regulators face between efficiency and fairness. As they tighten oversight on short-selling, leveraged trades, and high-frequency trading, they tread cautiously to maintain stability without stifling market dynamics.

Kher Sheng Lee, Asia-Pacific Co-Head of AIMA, a global lobby group representing fund managers, acknowledges the necessity of regulatory vigilance in maintaining market stability. However, Lee emphasizes the importance of striking a delicate balance between regulation and preserving the principles of free markets.

Navigating the Market Terrain

Beyond the immediate regulatory changes, the broader market context adds layers to this unfolding narrative. The CSI300 Index’s rebound from recent lows suggests a semblance of stability, climbing nearly 14% within a month. Yet, the specter of fragile economic growth looms, challenging the resilience of the market.

Delving into the data from China Securities Finance Corp, the balance of stocks borrowed for short selling plummeted to 43.5 billion yuan by the end of February, a two-thirds decline from the previous month and the lowest since July 2020. Notably, this data excludes other short positions through derivatives or stock futures, providing a nuanced perspective on the evolving market dynamics.

Adapting Strategies in a Shifting Landscape

Market participants must navigate this evolving landscape, adapting strategies to align with the changing regulatory currents. The shift in short positions serves as a catalyst for market players to reassess risk management approaches and explore alternative investment strategies.

China’s market narrative is in the midst of a compelling chapter, where regulatory initiatives intersect with market participants’ strategies. Striking the right balance will be pivotal as stakeholders traverse the intricate path between regulatory oversight and the dynamism essential for a thriving marketplace.